所屬分類:新聞動態發佈時間:2025-04-22

Hong Kong China ESG trends

HKEX and SFC Co-Host Inaugural International Carbon Markets Summit

On April 15, Hong Kong Exchanges and Clearing Limited (HKEX) and the Securities and Futures Commission (SFC) co-hosted the first-ever International Carbon Markets Summit, reflecting the collaborative effort to build trusted and effective carbon market ecosystems in Hong Kong and beyond.

The Summit welcomed over 200 distinguished guests from around the world, with representatives from local and overseas regulators, carbon trading platforms, corporates and the investment community, where they discussed the opportunities and challenges in developing global voluntary carbon markets, as well as ways to promote market connectivity and collaboration for cross-border carbon asset trading.

Source: https://www.hkex.com.hk/News/News-Release/2025/2504152news?sc_lang=en

International ESG trends

ESMA consults on rules for external reviewers of European Green Bonds

On April 7, the European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, has published its Consultation Paper on the remaining Regulatory Technical Standards (RTS) for external reviewers under the European Green Bonds Regulation.

The RTS relate to the following aspects of the external reviewer regime:

ESMA considers that these technical standards will enhance the robustness and transparency of external reviews of European Green Bonds and in turn boost investors’ confidence that their capital is genuinely driving the green transition.

Lianhe Green Insights:

For the bond market, the lack of standardized access and screening criteria for external reviewers has long been a pain point. By incorporating regulatory technical standards into its regulations, the European Securities and Markets Authority (ESMA) aims to enhance the green bond assessment framework, improve compliance practices, and boost information reliability. This move signals rising qualification requirements for external reviewers and reflects the green bond market's growing expectations for transparency.

IMO approves net-zero regulations for global shipping

On April 11, the International Maritime Organization (IMO) approved the draft amendments to Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL), mandating the implementation of the IMO's net-zero emissions framework. The IMO Net-zero Framework is the first in the world to combine mandatory emissions limits and GHG pricing across an entire industry sector.

The core objective of the new framework is to achieve net-zero emissions in the global shipping industry by 2050. It will apply to large ocean-going ships over 5,000 gross tonnage, which emit 85% of the total CO2 emissions from international shipping.

Source: https://www.imo.org/en/MediaCentre/PressBriefings/Pages/IMO-approves-netzero-regulations.aspx

Lianhe Green Insights:

The shipping industry remains heavily reliant on fossil fuels, with a notably slow decarbonization pace, making it one of the “hard-to-abate” sectors. As a global industry, shipping requires unified decarbonization rules to avoid fragmentation risks. The International Maritime Organization's (IMO) net-zero framework establishes a solid foundation for emission reductions, representing a crucial step toward achieving net-zero emissions for the sector by 2050.

Mainland China ESG trends

SZSE Published Green Bond White Paper to Solidify Green Finance Development

On April 7, 2025, the Shenzhen Stock Exchange (SZSE) released the Shenzhen Stock Exchange Green Bond White Paper. This initiative aims to implement the requirements of the China Securities Regulatory Commission's (CSRC) Guiding Opinions on the Capital Market's Implementation of the Five Major Articles of Financial Work. It reviews and summarizes the development of the SZSE's green bond market in recent years and highlights typical cases. The white paper is designed to guide and assist enterprises in fully utilizing bond market tools to promote their own green and low-carbon development. It also supports the acceleration of a comprehensive green transition in economic and social development, thereby laying a solid foundation for high-quality development with a focus on sustainability.

Source: https://www.szse.cn/aboutus/trends/news/t20250407_612784.html

Lianhe Green Insights:

By publishing the green bond white paper, the SZSE has systematically organized the policy framework for green bonds, further clarifying market standards and requirements. It provides practical guidance for enterprises on how to use bond market tools to advance their green and low-carbon development. Additionally, through the analysis of representative green bond cases, the white paper offers potential issuers a reference model for practice. It also provides investors with a data foundation for understanding market trends and assessing investment risks.

The Ministry of Ecology and Environment issued the Notice on Doing a Good Job in the Relevant Work of the National Carbon Emission Trading Market in 2025

On March 26, the Research Report on the Development Roadmap of China’s Hydrogen Energy Technology was officially released at the 2025 International Hydrogen Energy Conference and International Hydrogen Energy and Fuel Cell Industry Exhibition.

On April 15, the Ministry of Ecology and Environment released the Notice on Doing a Good Job in the Relevant Work of the National Carbon Emission Trading Market in 2025. The notice states that the list of key emission units for the national carbon emission trading market will be formulated annually and by industry. Units in the power generation, steel, cement, and aluminum smelting industries with annual direct emissions reaching 26,000 tons of CO₂ equivalent should be included in the list of key emission units.

Source: https://h5.h2cn.org.cn/3vdja5/202503/9a69004d03dc7e7e9e0e568ad3eae726.html

Lianhe Green Insights:

The National Carbon Emission Trading Market is accelerating its development. Initially covering about 2,200 key emission units in the power generation sector, it has now expanded to include three additional high-emission industries: steel, cement, and aluminum smelting. The newly added industries have an annual emission volume of approximately 3 billion tons of CO₂ equivalent, raising the overall market coverage to over 60%. This indicates that the carbon market is gradually maturing. The unified national cross-industry carbon trading mechanism will also more effectively promote emission reductions and optimize resource allocation. This expansion not only helps enterprises to strengthen carbon management and green transformation but also provides strong support for achieving the carbon peak target during the 14th Five-Year Plan period.

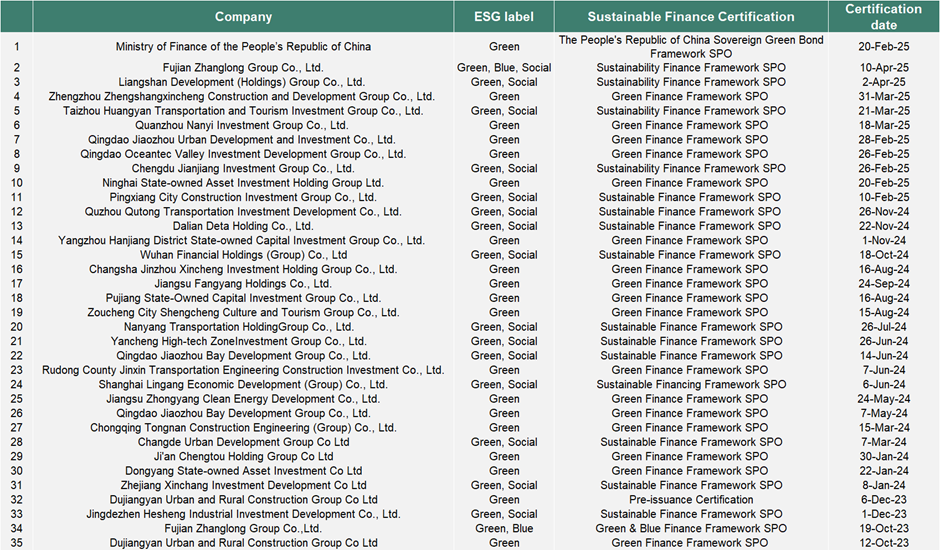

Sustainable Finance Certification Public and Completed by Lianhe Green