return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

[Major Update] Comprehensive Analysis of ICMA's Climate Transition Bond Guidelines

[Major Update] Comprehensive Analysis of ICMA's Climate Transition Bond Guidelines

return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

[Major Update] Comprehensive Analysis of ICMA's Climate Transition Bond Guidelines

[Major Update] Comprehensive Analysis of ICMA's Climate Transition Bond Guidelines

category:Reports and InsightsRelease time:2025-11-10

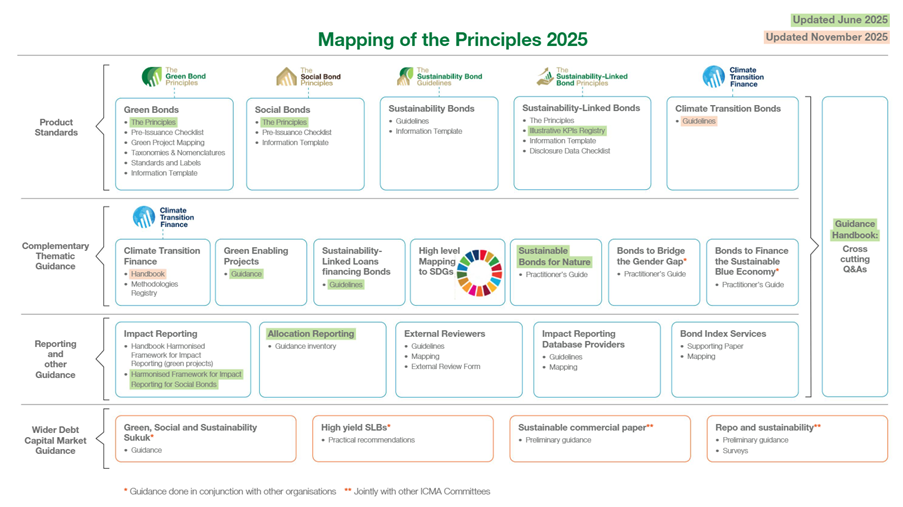

In November 2025, the International Capital Market Association (ICMA) officially launched the standalone Climate Transition Bond (CTB). This significant milestone marks a crucial upgrade in climate transition finance: evolving from the foundational framework established by the Climate Transition Finance Handbook (hereinafter referred to as the "Handbook") into a mature financing instrument with distinct product attributes, effectively filling the market gap for specialized financing products tailored to high-emission entities in transition.

Concurrently, ICMA released the Climate Transition Bond Guidelines (hereinafter referred to as the "Guidelines"), providing clear operational-level specifications for CTB issuance. These guidelines supplement the entity-level practices, actions, and disclosures recommended by the Handbook for sustainable bond issuers raising capital for their climate transition strategies.

With this development, the mainstream sustainable financing instruments in the green bond market now clearly comprise five categories: Green Bonds, Social Bonds, Sustainability Bonds, Sustainability-Linked Bonds, and the newly added Climate Transition Bond (CTB). This further completes the sustainable financing product matrix designed to address diverse emission reduction needs and issuer types.

This move by ICMA aims to address the $30 trillion transition financing gap required to meet the Paris Agreement goals. While traditional instruments like green bonds focus exclusively on "mature projects that already meet green standards," high-emission sectors (such as steel, cement, oil and gas) have long faced barriers to accessing sustainable financing due to their current lack of purely green assets.

Today, Lianhe Green will provide an in-depth analysis of core issues in the transition bond space from an external reviewer's perspective. Detailed updates regarding specific documents will be presented in subsequent thematic articles.

Q1:What’s the Requirements for Use of Proceeds under CTB?

CTB requires the proceeds be used for eligible Climate Transition Projects (CT Projects). CT Projects are defined as including assets, investments and activities, early phase-out and decommissioning, and other expenditures such as R&D related to high-emission activities that lead to substantial and quantifiable GHG emissions avoidance, reduction, or removal.

Issuers should meet the following safeguards:

Existence of an issuer-level sustainability and/or climate transition strategy to which the CT Projects contribute and incorporating disclosures which align on a best-efforts basis with the four key elements of the Climate Transition Finance Handbook;

Analysis supporting the technological and/or economic unfeasibility of low-carbon alternatives for the issuer considering also the local context;

Alignment or compatibility with official sector and market-based taxonomies (including Green Finance Endorsed Project Catalogue (2025 Edition), decarbonisation pathways and roadmaps, and/or other international and national decarbonisation policy frameworks;

Mitigation of substantial and quantifiable GHG emissions beyond business-as-usual (BAU);

Identification, analysis, best-efforts mitigation, and disclosure of carbon-lock in risks.

Where a CT Project substantially relates to fossil fuel infrastructure or activities, and to the extent not already addressed by alignment with a taxonomy, pathway, roadmap or policy framework as per above, additional safeguards may be needed:

activity/asset level transition plans;

commitment to decommission/phase-out assets or switch to a low-carbon alternative within a certain timeframe consistent with credible scenarios;

annual reporting on forward-looking metrics such as key milestones, sunset dates, and external verification thereof;

implementation of accompanying investments and flanking measures to enable low-carbon alternatives in the future;

limitations to fossil fuel capacity expansion or assets’ lifetime extension as a result of or in the context of a CT Project’s implementation;

limitation of CT Project eligibility to assets already in existence as of a certain date (i.e. brownfield investments); and/or,

commitment to implement CCUS for further abatement.

A preliminary and non-exhaustive list of eligible CT Project categories is available in Annex of the Guidelines. The ultimate classification remains with the issuer based on its own assessment following the safeguards above.

Q2: The Connection Between CTB and Green Bonds

Both CTB and green bonds fall under the category of Use of Proceeds (UoP) bonds. The Guidelines require that the proceeds of CTBs (or an equivalent amount) be allocated to CT Projects, while the proceeds of green bonds (or an equivalent amount) shall also be used for eligible Green Projects.

CTB is an independent label for a specific product category, specifically serving CT Projects in high-pollution industries. It primarily targets high-emitting enterprises (e.g., steel, petroleum, etc.) or entities engaged in high-emitting activities—these entities do not yet have mature green assets but have clear decarbonization needs. However, CT Projects complement and go beyond the scope of the Green Bond Principles ("GBP"). They do not require the projects themselves to meet "green standards"; instead, they place greater emphasis on the emission reduction value generated during the transition process.

It is inherently difficult to draw a line between a CT Project and a Green Project. The Guidelines do not therefore aim to make any final determination on their classification, which remains with the issuer, based on its own assessment and methodology aligned with the definition and safeguards for CT Projects. When CTBs are not exclusively (re)financing CT Projects, the reminder of the projects should be allocated to eligible green projects as defined by the GBP.

The following table presents a comparison between eligible CT Project categories and eligible Green Project categories.

|

Eligible Green Project categories |

Eligible CT Project categories |

|

Renewable energy (including production, transmission, appliances and products); Energy efficiency (such as in new and refurbished buildings, energy storage, district heating, smart grids, appliances and products); Pollution prevention and control (including reduction of air emissions, greenhouse gas control, soil remediation, waste prevention, waste reduction, waste recycling and energy/emission-efficient waste to energy); Environmentally sustainable management of living natural resources and land use (including environmentally sustainable agriculture; environmentally sustainable animal husbandry; climate smart farm inputs such as biological crop protection or dripirrigation; environmentally sustainable fishery and aquaculture; environmentally sustainable forestry, including afforestation or reforestation, and preservation or restoration of natural landscapes); Terrestrial and aquatic biodiversity conservation (including the protection of coastal, marine and watershed environments); Clean transportation (such as electric, hybrid, public, rail, non-motorised, multi-modal transportation, infrastructure for clean energy vehicles and reduction of harmful emissions); Sustainable water and wastewater management (including sustainable infrastructure for clean and/ or drinking water, wastewater treatment, sustainable urban drainage systems and river training and other forms of flooding mitigation); Climate change adaptation (including efforts to make infrastructure more resilient to impacts of climate change, as well as information support systems, such as climate observation and early warning systems); Circular economy adapted products, production technologies and processes (such as the design and introduction of reusable, recyclable and refurbished materials, components and products; circular tools and services); and/or certified eco-efficient products; Green buildings that meet regional, national or internationally recognised standards or certifications for environmental performance. |

Carbon Capture, Utilisation and Storage (CCU, CCS), and carbon removal technologies, applied to fossilbased energy and industrial applications including associated infrastructure investments for CO2 transportation and storage, excluding uses for enhanced oil recovery. Early retirement and decommissioning of high-emission assets, including the permanent early retirement of coal-fired power plants (CFPPs). Fossil fuel switch (e.g. coal to gas) demonstrably replacing a higher emitting fuel and subject to infrastructure design allowing the future integration of low-carbon alternatives, monitoring and control of methane and other fugitive emissions, and CCUS, as relevant. Lower-carbon fuels including their production, use, purchase, and enabling infrastructure investments. Methane and flaring abatement in oil & gas infrastructure existing as of the initial publication date of the Guidelines. Eligible measures should be aligned with long-term decarbonisation goals and exclude uses for enhanced oil recovery, greenfield exploration and production activities. |

In addition to disclosing the four core elements consistent with green bond frameworks, CTBs also recommend that issuers clearly outline their overarching sustainability and/or climate transition strategies in their CTB frameworks to which the CT projects contribute and incorporating disclosures which align on a “best-efforts” basis.

Q3: What’s the Requirements for Use of Proceeds under CTB?

Same as green bonds, ICMA recommend issuers to obtain external reviews during pre and post-issuance period to improve transparency.

The pre-issuance external review assesses the alignment of the bond's four core components (Use of Proceeds, Project Evaluation and Selection, Management of Proceeds, and Reporting) with the Guidelines.

Post issuance, it is recommended that an issuer’s management of proceeds be supplemented by the use of an external auditor, or other third party, to verify the internal tracking and the allocation of funds from the CTB proceeds to eligible CT Projects. In addition, there are various ways for issuers.

Q4: Can CTB be issued in the form of linked bonds?

No. CTBs are exclusively structured as Use of Proceeds (UoP) bonds. High-emission issuers willing to commit explicitly to future emission reductions at the entity-level can issue climate transition-themed Sustainability Linked Bonds (“SLBs”). Issuers are strongly encouraged to incorporate disclosures which align on a “best-efforts” basis with the four key elements of the Handbook.

Q5: Compared to ordinary sustainability-linked bonds, what are the characteristics of climate transition-themed sustainability-linked bonds?

Selection of KPI: one or more of the KPIs should monitor GHG emission reductions. In cases where a Scope 3 GHG emissions KPI/SPT is not feasible, issuers may consider using a “green” CapEx KPI to demonstrate their commitment and progress towards reducing GHG emissions in their industry.

Setting of SPT: The Guidelines provide relatively clear pathways or international scenarios as references for setting SPTs, such as the Science Based Targets initiative (SBTi), the Accelerating Climate Transition (ACT) initiative, and those from the International Energy Agency (IEA).

Lianhe Green holds the view that the release of the Guidelines and the launch of the dedicated CTB label have filled the gap in global transition finance products and represent a milestone in unlocking the transition momentum of high-emitting industries. Prior to the issuance of the Guidelines, global transition finance had long been plagued by the predicament of "vague concepts and ambiguous boundaries." Transition projects of high-emitting entities struggled to secure sustainable financing support as they failed to meet green bond standards. The guidelines and label launched by ICMA this time have accurately addressed the core pain points of the market.

Lianhe Green will always adhere to the principles of independence, objectivity, professionalism and prudence. Leveraging its profound experience in the field of sustainable bond certification, the company is committed to assisting high-emitting entities in achieving credible transitions and building a solid bridge for the in-depth integration of global climate goals and the senior market.