return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

[Monthly Report] In-depth analysis of Guidelines for Blue Finance Version 2.0 Standardization Empowers the Blue Economy

[Monthly Report] In-depth analysis of Guidelines for Blue Finance Version 2.0 Standardization Empowers the Blue Economy

return

return

current location:Home

current location:Home

Reports and Insights

Reports and Insights

Reports and Insights

Reports and Insights

[Monthly Report] In-depth analysis of Guidelines for Blue Finance Version 2.0 Standardization Empowers the Blue Economy

[Monthly Report] In-depth analysis of Guidelines for Blue Finance Version 2.0 Standardization Empowers the Blue Economy

category:Reports and InsightsRelease time:2026-01-28

1. Introduction to Version 2.0 of IFC’s Guidelines for Blue Finance

Since the release of our first Guidelines for Blue Finance in 2022, IFC has mobilized more than $2 billion in blue loans and bonds, supporting a growing portfolio of investments that span plastics recycling, water security, and marine conservation. Blue-labeled transactions are increasing, investor interest is growing. While still in its infancy, the market is beginning to thrive with increasing investments and innovative financing instruments directed towards the blue economy. The publish of IFC’s Guidelines for Blue Finance V2.0 (“the guideline”) responds to this momentum, which is designed to help financial institutions and market stakeholders identify, structure, and scale investments that contribute to the sustainable use of water and ocean resources. The Guideline is meant to be a practical tool to help launch, evaluate, or expand your blue finance activities.

2. Blue Guidance Framework

The Blue Guidance Framework helps to identify blue eligible activities and businesses through the application of the following criteria:

a. Does the activity or business make a substantial contribution to the regeneration, protection, or sustainable use of marine and/or freshwater resources, aligned with the objectives of SDGs 6 (Clean water and Sanitation) and/or 14 (Life below water), beyond compliance with applicable laws and regulations?

b. Does the activity or business introduce risk3 that may affect progress on other social and environmental aspects, including the objectives of the Paris Agreement?

c. Are environmental and social (E&S) safeguards and standards, such as the IFC Performance Standards,5 applied to anticipate and avoid (if avoidance is not possible, then to minimize), compensate or offset E&S risks and potential impacts associated with implementing the activity or conducting business?

A Themed Guidance within Green and Sustainable Finance

Blue finance is a thematic subcategory of green and sustainable finance. These Guidelines are intended to support issuers and borrowers in developing both use-of proceeds and general-purpose financial instruments with a blue focus. It can also help companies define or structure their business models and develop programs to incorporate blue elements. Blue financial instruments have an objective to emphasize the importance of the sustainable use of maritime resources and promote related sustainable economic activities

To label a financial instrument as a blue bond, a blue loan, a sustainability-linked bond (with a blue focus), or a sustainability-linked loan (with a blue focus), the instrument must comply with the core components and requirements of the overarching principles and recommendations of the Green Bond Principles, the Green Loan Principles, the Sustainability-Linked Bond Principles (SLBPs), and/or the Sustainability-Linked Loan Principles (SLLPs), respectively. In addition, it must align with the Blue Guidance Framework outlined in this document, which serves as a transparent way to avoid green or blue washing and could help safeguard against reputational risk.

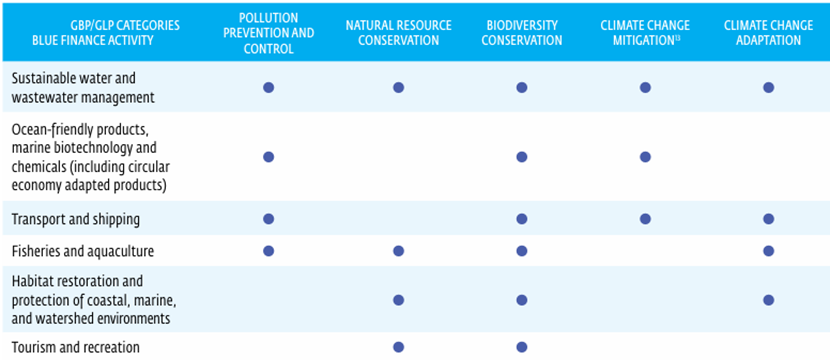

Table 1. Mapping of blue activities to the green categories under the Green Bond Principles and the Green Loan Principles

Source: Guidelines for Blue Finance Version 2.0

3. Blue Eligible Activities and Indicators for Blue-related Activities

Eligible blue activities must contribute substantially to sustainable water management and/or freshwater or ocean protection, deliver measurable outcomes, and be aligned with the Blue Guidance Framework.

Eligible activities include the financing and refinancing of research, design, manufacturing, developing, and implementing initiatives across multiple blue economic sectors such as sustainable water and wastewater management, marine biotechnology and chemicals, transport and shipping, fisheries and aquaculture, habitat restoration and protection, and tourism and recreation.

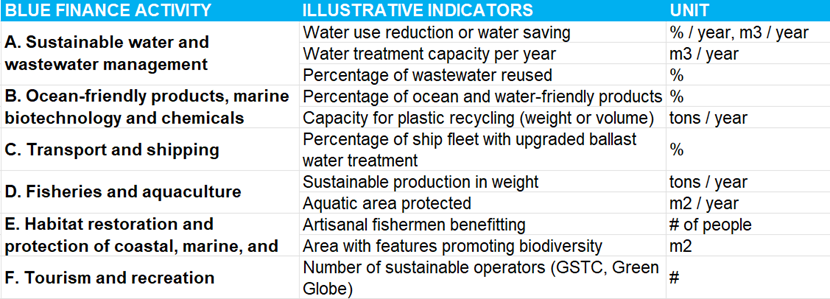

For blue-labeled financial instruments, impact indicators can be used to demonstrate the environmental and social benefits and co-benefits generated from blue eligible activities. Examples are shown below:

Table 2. Illustrative blue impact indicators (examples only)

Source: Excerpt from the Guidelines for Blue Finance Version 2.0

Lianhe Green Insights:

As an external assessment institution deeply rooted in the sustainable finance sector, Lianhe Green opines that the release of the Guideline marks a pivotal step forward for global blue finance in the direction of standardization and verifiability. Centered on the core strengths of precision in implementation, alignment of standards and measurable impact, the Guideline represent a crucial leap from the "fundamental definition" of Version 1.0 to "full-process practical empowerment". Its expanded scope of eligible project categories, established quantitative indicator system and integrated financial instruments linked to blue finance have effectively addressed the industry pain points of ambiguous definition of blue projects and difficult verification of their benefits, providing a unified and adaptable standard framework for global blue finance.

Meanwhile, from the perspective of preventing green washing and blue washing, the Guideline has built an anti-bluewashing mechanism through alignment with international standards. This not only reduces information asymmetry in the market but also strengthens the stringency of compliance, which will undoubtedly accelerate the aggregation of capital into the marine and freshwater conservation sectors and inject strong impetus into the sustainable development of the blue economy. Going forward, Lianhe Green will leverage independent, objective and professional assessment practices to facilitate the development of a credible and transparent blue finance market ecosystem, and transform the principled requirements of the Guidelines into tangible conservation outcomes for marine and freshwater resources.

For the full document, please refer to the link below: Guidelines for Blue Finance Version 2.0